what is income tax malaysia

As the name implies individual income tax in Malaysia is imposed on earned in Malaysia or received in Malaysia from outside Malaysia. 13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of.

Withholding Tax On Foreign Service Providers In Malaysia

It will be applied to.

. Money collected through taxes is used for government and. 7 Tips to File Malaysian Income Tax For Beginners Melly Ling March 24 2021 1. However if you claimed RM13500 in tax.

In this light every individual is subject to tax on. 30 on over 2 million MYR. 28 on the next 1 million between 1000001 and 2 million.

So the more taxable income you earn the. Corporate - Taxes on corporate income. An income tax is a type of tax that governments impose on businesses and individuals earning income.

The income tax of non-residents is calculated on a three-step tax rate 27 15 and 10 depending on the type of income. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are. Before you can file your taxes online there are two things that you will need.

So the more taxable income you earn the. The income tax rate for residents is calculated on the. RM55000 Gross Income RM9000 Taxable deductible expenses RM2000 Tax Exemption RM4400 Tax Relief RM39600 Chargeable Income Tax Calculation is no Easy Task.

The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. 26 when the income is between 600001 and 1 million.

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is. Resident of Malaysia Tax rates are as follows 2019-2020 Let me give you an example on how to calculate your Income Tax based on the chart above.

Total income - tax exemptions and reliefs chargeabletaxable income. The income tax in Malaysia for non. Your tax rate is calculated based on your taxable income.

However there are exceptions for certain. Corporate income tax in Malaysia is a direct tax paid to the government imposed on both resident and non-resident companies that receive income from Malaysia. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. Income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia An individual whose. What is the income tax rate in Malaysia.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from. Total income - tax exemptions and reliefs chargeabletaxable income Your tax rate is calculated based on your taxable income.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Tax Guide For Expats In Malaysia Expatgo

Personal Tax Relief 2021 L Co Accountants

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Scraps 6 Consumption Tax To Meet Election Pledge Bloomberg

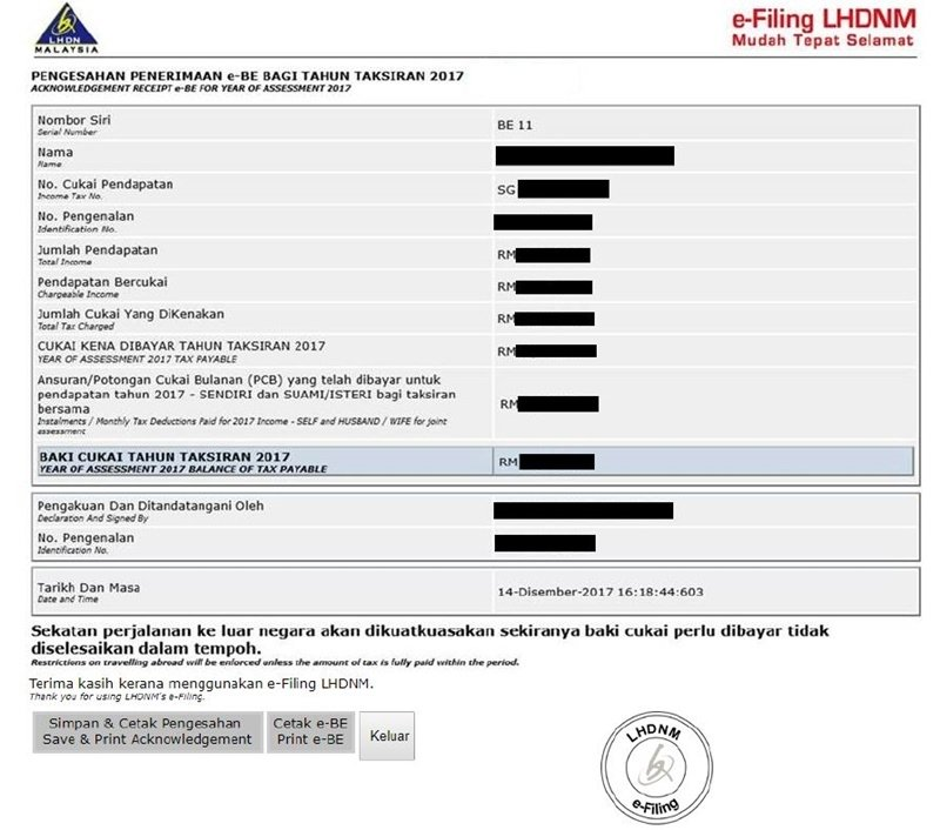

Guide To Using Lhdn E Filing To File Your Income Tax

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Comprehensive Malaysia Data Retention Schedule Data Retention Schedule Filerskeepers

The Complete Personal Income Tax Guide 2014 Infographic Tax Guide Income Tax Income

Malaysia Personal Income Tax Guide 2020 Ya 2019

2 202 Income Tax Malaysia Images Stock Photos Vectors Shutterstock

Individual Income Tax In Malaysia For Expatriates

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

A Malaysian S Last Minute Guide To Filing Your Taxes

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

0 Response to "what is income tax malaysia"

Post a Comment